Voters’ blood pressure has soared as rising gasoline prices have hammered

their budgets. Many heap blame on President Obama as they have on past

presidents for events that occur under their administrations, perhaps because

politicians running for office claim they can fix all problems. Seizing an

opportunity to win votes, Republican politicians blame President Obama’s policy

for rising gasoline prices and promise to dramatically lower prices just as

Democratic claimed power to solve pertinent economic problems four years ago.

Politicians are not omnipotent and even when policies affect outcomes; their

policies can be overwhelmed by market forces.

The graph “EIA U.S. All Grades Formulations Retail Gasoline Prices” plots the

price of gasoline over the past eleven years beginning with President Bush’s

first term. As President Obama’s Republican critics state, the price of gas has

nearly doubled since he took office. Picking a starting point is a good way to

trick unwary readers. By using a longer time frame, it is clear that rising

prices preceded the Obama administration and that the trend was only interrupted

by the Great Recession. In March 2001, the price of gasoline was $1.45 per

gallon compared to $3.64 per gallon last week.

In this post, I use tools presented to principles of economics students to

describe the markets for gas and related products and the possible influence

events and policy have on them.

Skip the remainder of this paragraph if you are not interested in the

pedagogical background of supply and demand. The demand for gas can be described

using an equation without functional form, Qg=D(Pg, I, Ps, Pc, N, Txd), where Qg

is the quantity of gas demanded, Pg is the price of gas, I is the income level

of consumers, Ps is the price of substitutes for gasoline, Pc is the price of

complementary goods, goods used with gasoline, N is the number of consumers, and

Txd is taxes on consumers. The supply for gas can be similarly described,

Qg=S(Pg, Pi, Tc, Txs, E), where Qg is the quantity of gas supplied, Pg is the

price of gas, Pi, the price of inputs, Tc, technology, Txs, taxes on suppliers,

and E, suppliers’ expectations.

The Law of Demand states that holding all variables but price and quantity

constant, as price rises, the quantity demand of a good or service falls. The

Law of Supply states that holding all variables but price and quantity constant,

as price rises the quantity supplied increases. The graph “U.S. Gasoline

Market: 2001-2012” is a simplification of the market at the beginning and end of

the eleven years. It depicts supply and unchanging and contains two demand

curves, the first for March 2001 and second, March 2012; the equilibrium prices

are taken from the trend line in the first graph.

In the remainder of post, I change one supply or demand variable at a time to

explain the trend; this technique is called comparative statics. The first

variable of note is income (I). Over the last two decades, world income has

grown rapidly, leading to increased demand for gasoline with much of that demand

coming from China and India. While income has grown, the increase in gasoline

prices has had a subtle negative impact on income. The increase in gasoline

prices reduces remaining purchasing power producing the same result as a

decrease in income. Because consumers can substitute away from gasoline, the

increase in income will not be completely offset by the increase in gasoline

prices. The increase in world income is probably the most important variable

causing demand to increase (shift to the right from D01 to D12) between 2001 and

2012.

To understand the market for gasoline, it is necessary to understand the

market for its most important input, oil. The cost of producing gasoline

largely reflects the price of its major input (Pi), oil. The supply equation for

oil is slightly different than that of gasoline, Qo=S(Po, Tco, Txo, R) where the

variables, where Qo is the quantity of oil produced, Po is the price of oil, Tco

is oil technology, Txo is taxes on oil and R is oil reserves.

I believe that it is the reserve of oil (R) that explains the lack of a

supply response to the upward march of prices. As demand has increased,

increasing prices, gasoline manufacturers have a profit incentive to produce

more, requiring more oil. The oilfields that are cheapest to exploit are

producing. New oil must be produced from fields that are more costly and time

consuming to exploit. New technology, (Tco), such as the conversion of tar

sands to oil in Canada and hydraulic fracturing will allow supply to expand more

rapidly (a movement from S to SI), slowing the pace of oil price increases

directly and gasoline prices through its major input, oil, but when all is said

and done, oil is a finite resource and its reserves will eventually be

depleted.

In 2008, candidate Obama ran in part as an environmental warrior ready,

willing and able to use the resources of United States government to combat

carbon emissions primarily from the consumption of oil and coal. In office,

President Obama has introduced programs that affect the price of substitute

goods to gasoline. He promoted the electric car with $7,500 per vehicle tax

credits (a subsidy is a negative tax, Tx), and invested directly in alternative

fuel companies lowering the price of substitutes, a type of related good. The

graph “U.S. Gasoline Market: Shifts in Demand” illustrate the impact of these

policies. Because they make alternatives to gasoline less expense,

they decrease the demand for gasoline (shifting demand to the left, D to DD

where DD is a decrease in demand). He has also increased EPA standards for all

vehicles (a constraint on the technology of complements (Tc). This technology

variable is part of the supply of vehicles. On the demand side, higher EPA

standards increase the fixed price of a compliment to gasoline while lowering

the operating price making the overall impact on the demand for gasoline is

ambiguous.

The graph “U.S. Gasoline Market: Shifts in Supply” depicts possible supply

responses. On the supply side, the administration quietly followed a policy to

slow down the domestic production of oil which again, other things equal,

decreases supply (a shift from S12 to SD where SD is a decrease in supply)

and increases the price of gasoline. In a 2008 interview with the Wall Street

Journal, Steven Chu who is now the energy secretary, said, “Somehow we have to

figure out how to boost the price of gasoline to the levels in Europe.” The

price of a gallon in Europe is above $8.00 per gallon. This policy might makes

sense if you believe that carbon emission will cause extensive and costly damage

to the economy and if unilateral action of the part of the United States will

significantly slow global carbon emissions.

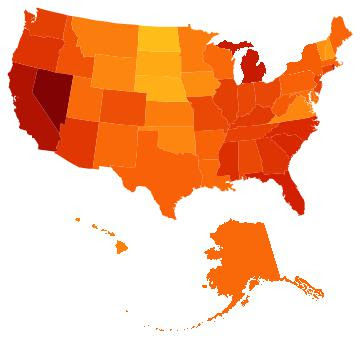

The president claims an “all of the above approach” to energy production but

policy seems aimed at slowing production without saying no. In Alaska, the

administration has slow walked approval of infrastructure projects necessary to

extract oil. In the Caribbean, the time it takes to get a permit to drill has

nearly doubled. Leases to drill on federal land in the West are down 40%. The

administration killed the Keystone XL pipeline that would bring tar sands oil to

the United States. Each project has a legitimate environmental concern, but

when all are summed, they total a policy aimed at maintaining high gasoline

prices by slowing exploration and extraction that would lead to increasing the

supply of gasoline.

These policies reduce the purchasing power of U.S. consumers. They can only

be welfare improving if the environmental benefits exceed the loss in purchasing

power. They are unlikely to bring technological breakthroughs. European

countries maintain policies that have kept gasoline prices high for a very high

for a very long time and they have not resulted in technological

breakthroughs. It seems unlikely that policies designed to do the same here

will have any more success.

Candidate Gingrich has claimed that if elected, his policies would lead to

$2.50 per gallon gasoline. If elected, he would control U.S. policy, not

markets and market forces are likely to overwhelm policy. Like candidate Obama,

he promises too much.

If you believe that carbon emissions are costly to future generations and

that unilateral U.S. action can reduce emission, policies to restrict gasoline

supply make sense. If you do not, they do not. If you believe that the

government is better at venture capital, investing in startup companies, than

markets, then the president’s policies make sense. If you do not, they do

not.

Read more!